Watt Consultants offers robust Energy Resource Planning (ERP) services to support energy developers, asset managers, investors, and infrastructure planners in maximizing the value of their energy portfolios. Our approach blends advanced financial modeling, scenario forecasting, market intelligence, and policy analysis to empower strategic decision-making in a rapidly evolving energy landscape.

Energy Asset Economics

WattC conducts techno-economic evaluations of energy projects across their lifecycle, from feasibility to post-commercial operation. We build customized financial cash flow models, cost-benefit analyses, and pro forma projections for standalone and hybrid energy systems. Our experts support pricing strategy through PPA bid modeling, levelized cost of energy/storage (LCOE/LCOS) assessments, and valuation of stacked revenue streams for DERs and grid services.

Revenue Forecasting & Dispatch Modeling

For renewable, storage, and hybrid projects, we forecast energy market revenues using historic trends and scenario-based simulations. We develop dispatch models for hybrid configurations (e.g., solar + BESS) to optimize cycling, arbitrage, and capacity commitments based on tariff structures and market rules.

Market Analysis & Positioning

WattC provides in-depth analysis of energy, capacity, and ancillary services markets, identifying price trends, locational advantages, and participation strategies. We assess emerging market structures, evaluate resource entry opportunities, and benchmark technologies and developers to inform business development efforts.

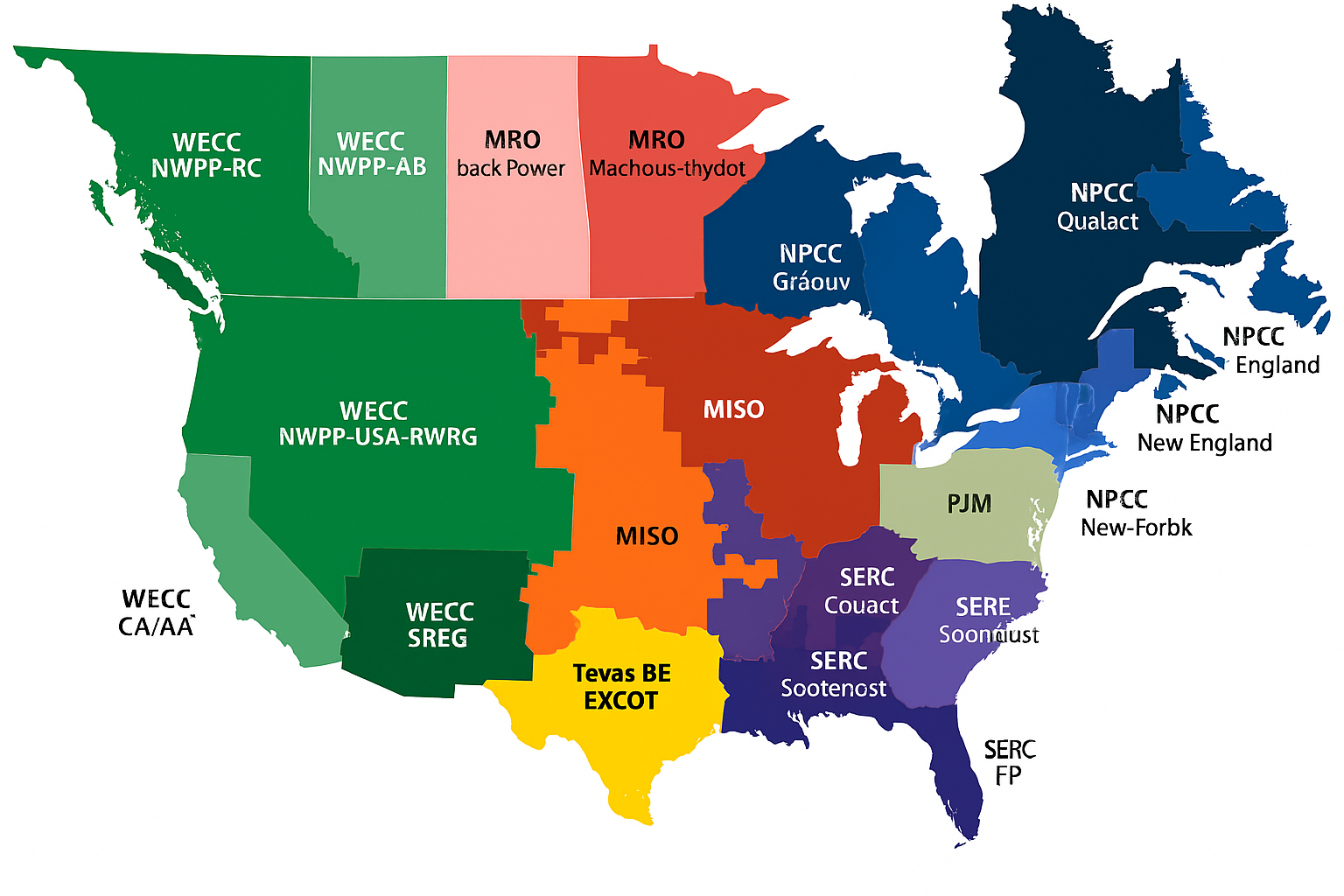

Policy & Regulatory Strategy

We track key federal, state, and ISO/RTO regulations affecting energy resources, including interconnection rules, carbon pricing, and capacity accreditation. WattC helps clients evaluate how policy changes affect project economics and investment timing, and provides input for regulatory filings or stakeholder engagement.

Technology & Business Model Evaluation

Our team analyzes the technical viability, cost trajectory, and commercialization potential of new energy technologies including long-duration storage, hydrogen, microgrids, and demand flexibility solutions. We help clients refine business models and assess integration pathways into existing portfolios.

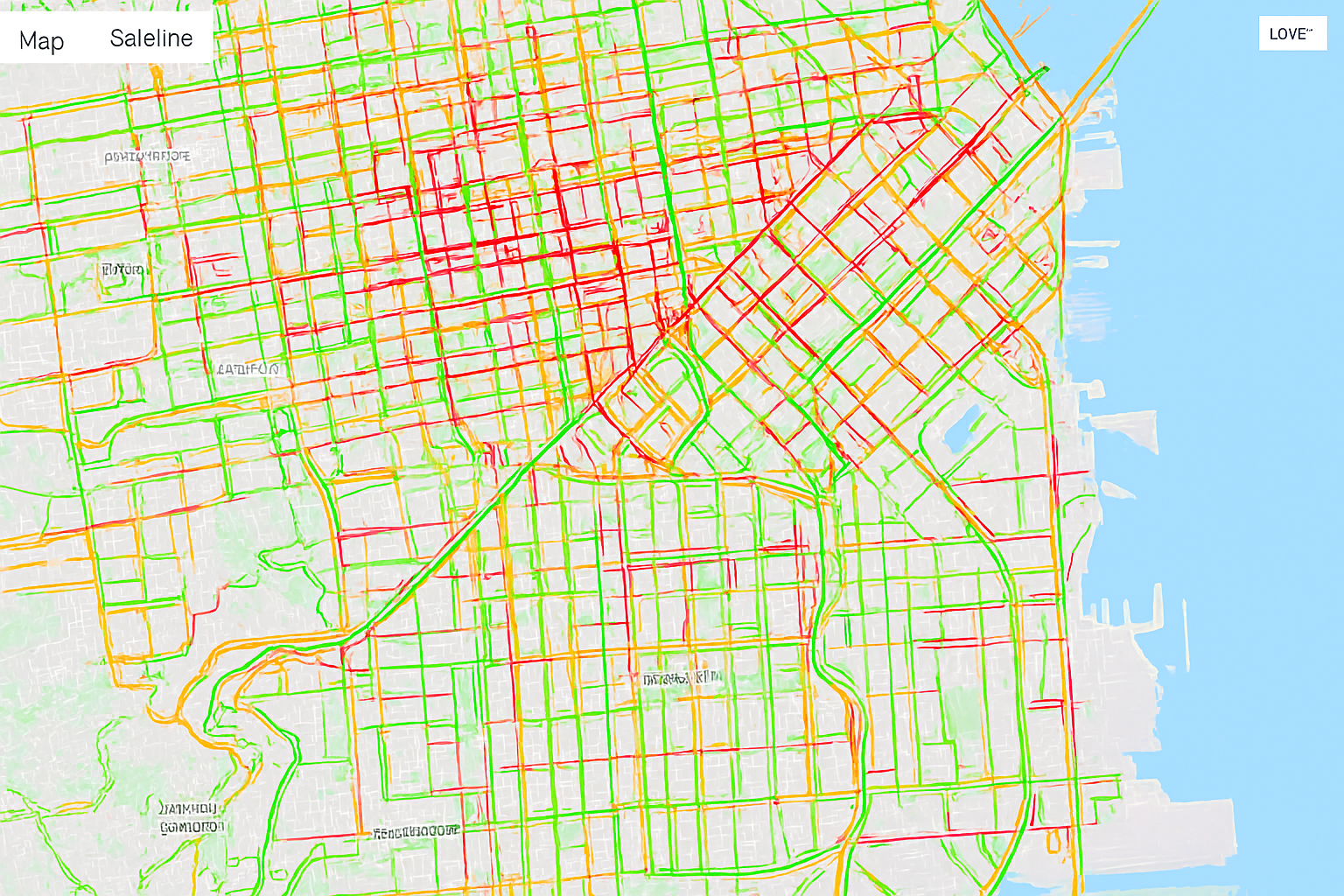

Grid Modernization & Decentralized Energy Planning

We provide insights into grid evolution trends, DER enablement policies, and decentralized resource potential. These studies guide strategic investment, risk assessment, and positioning in regional and distribution-level energy markets.

Dynamic and Transient Stability Analysis

Our team utilizes PSS®E to assess the system’s dynamic response to disturbances. This includes:

- Calculating critical clearing times

- Detecting low-frequency oscillations

- Verifying damping performance

- Evaluating the behavior of protection and special protection schemes (SPS)

These studies help ensure system resilience and compliance under a wide range of operating scenarios.

Short-Circuit Analysis

Using Aspen OneLiner, we perform detailed fault current studies to evaluate:

- Fault contributions at critical buses

- Breaker interrupting capabilities

- The adequacy of protection system coordination

Our analysis ensures compliance with ISO/RTO criteria and informs system protection upgrades and equipment procurement decisions.

Transfer Limit Evaluation

We assess thermal, voltage, and stability-based transfer capabilities across key intra- and inter-area interfaces. These transfer limits support:

- Loss of Load Expectation (LOLE) analyses

- Operational planning

- System adequacy evaluations

- Infrastructure investment decisions